Things about Pvm Accounting

Things about Pvm Accounting

Blog Article

Some Of Pvm Accounting

Table of ContentsThe Only Guide to Pvm AccountingLittle Known Facts About Pvm Accounting.Examine This Report on Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.What Does Pvm Accounting Do?The Facts About Pvm Accounting Revealed

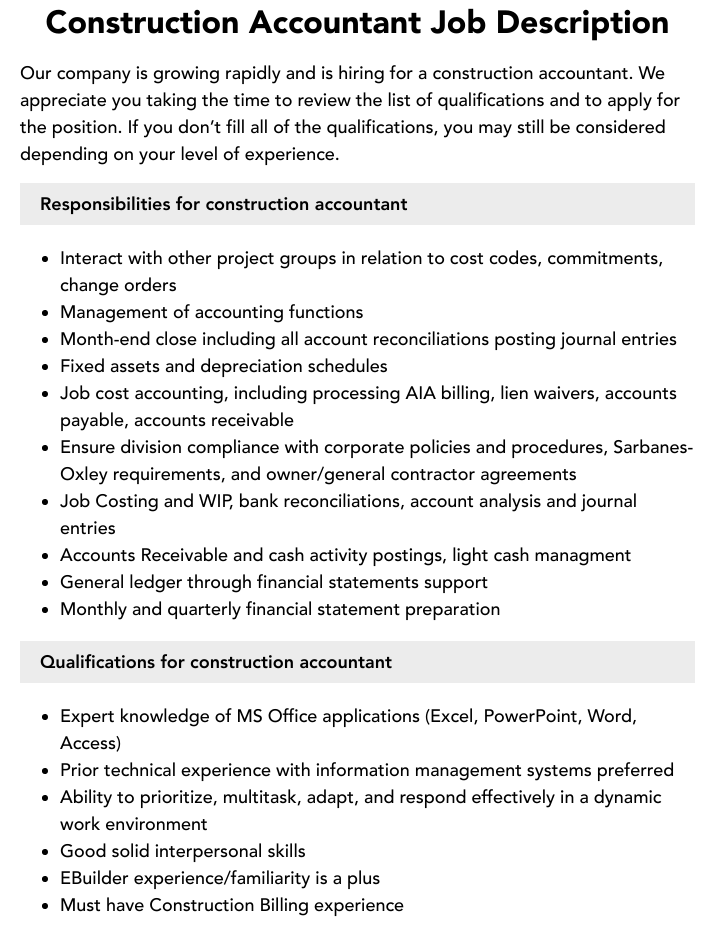

Guarantee that the accountancy process abides with the law. Apply needed building and construction accountancy requirements and treatments to the recording and coverage of building and construction task.Understand and keep common price codes in the accounting system. Communicate with numerous financing companies (i.e. Title Business, Escrow Business) pertaining to the pay application procedure and requirements needed for payment. Manage lien waiver dispensation and collection - https://www.provenexpert.com/leonel-centeno/?mode=preview. Display and deal with bank concerns consisting of cost abnormalities and examine distinctions. Aid with applying and maintaining internal monetary controls and procedures.

The above statements are planned to define the general nature and level of job being performed by individuals appointed to this classification. They are not to be understood as an exhaustive list of responsibilities, obligations, and abilities needed. Workers may be called for to perform responsibilities beyond their regular obligations every now and then, as required.

10 Simple Techniques For Pvm Accounting

Accel is seeking a Building and construction Accounting professional for the Chicago Office. The Building and construction Accountant does a selection of bookkeeping, insurance policy conformity, and job management.

Principal duties include, yet are not limited to, managing all accounting features of the company in a timely and precise manner and supplying records and schedules to the company's CPA Firm in the prep work of all economic statements. Ensures that all bookkeeping procedures and features are handled properly. Liable for all monetary records, pay-roll, financial and everyday procedure of the audit feature.

Prepares bi-weekly test equilibrium records. Works with Project Managers to prepare and publish all regular monthly invoices. Procedures and concerns all accounts payable and subcontractor settlements. Creates month-to-month wrap-ups for Workers Settlement and General Responsibility insurance policy costs. Produces monthly Work Price to Date reports and working with PMs to reconcile with Task Managers' budget plans for each project.

The Main Principles Of Pvm Accounting

Proficiency in Sage 300 Construction and Realty (formerly Sage Timberline Office) and Procore building and construction management software an and also. https://canvas.instructure.com/eportfolios/2921746/Home/Navigating_the_Maze_of_Construction_Accounting_A_Comprehensive_Guide. Should likewise be efficient in other computer software program systems for the preparation of records, spreadsheets and various other bookkeeping evaluation that may be called for by management. construction taxes. Have to possess solid business skills and capability to focus on

They are the economic custodians who make sure that building and construction projects stay on spending plan, comply with tax guidelines, and keep financial transparency. Building accounting professionals are not simply number crunchers; they are tactical partners in the building and construction procedure. Their primary role is to handle the economic aspects of construction jobs, making sure that sources are alloted efficiently and financial risks are reduced.

The Ultimate Guide To Pvm Accounting

They function carefully with job managers to create and monitor budgets, track expenses, and projection economic requirements. By preserving a tight grasp on task financial resources, accountants help stop overspending and monetary problems. Budgeting is a cornerstone of effective building and construction jobs, and construction accountants are crucial hereof. They produce detailed spending plans that include all project expenditures, from products and labor to permits and insurance.

Construction accounting professionals are fluent in these regulations and make sure that the task abides click site with all tax demands. To succeed in the role of a building accounting professional, people need a solid instructional structure in accounting and finance.

In addition, qualifications such as Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Industry Financial Specialist (CCIFP) are very related to in the market. Building projects frequently involve limited deadlines, transforming laws, and unforeseen expenses.

The Best Strategy To Use For Pvm Accounting

Expert accreditations like CPA or CCIFP are also very advised to show proficiency in construction accounting. Ans: Construction accounting professionals develop and keep an eye on budget plans, identifying cost-saving opportunities and making certain that the task stays within budget. They also track expenditures and forecast monetary needs to avoid overspending. Ans: Yes, building and construction accounting professionals manage tax obligation conformity for building projects.

Introduction to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies have to make difficult options amongst lots of financial options, like bidding process on one job over an additional, selecting funding for materials or devices, or establishing a job's earnings margin. Building and construction is a notoriously unpredictable industry with a high failing price, slow time to settlement, and inconsistent money circulation.

Common manufacturerConstruction company Process-based. Manufacturing includes repeated procedures with quickly recognizable expenses. Project-based. Production calls for different procedures, materials, and tools with varying expenses. Fixed area. Manufacturing or manufacturing occurs in a solitary (or a number of) regulated places. Decentralized. Each task occurs in a brand-new place with differing site problems and distinct obstacles.

Facts About Pvm Accounting Revealed

Long-lasting relationships with vendors relieve settlements and boost performance. Inconsistent. Frequent use of different specialty specialists and distributors influences performance and capital. No retainage. Settlement shows up completely or with normal payments for the full agreement quantity. Retainage. Some section of settlement might be held back till task conclusion also when the specialist's job is completed.

Regular production and temporary agreements lead to convenient capital cycles. Irregular. Retainage, slow-moving repayments, and high in advance costs bring about long, uneven capital cycles - financial reports. While typical makers have the advantage of regulated atmospheres and maximized manufacturing processes, construction business should constantly adjust to each brand-new job. Also somewhat repeatable projects need modifications as a result of site problems and other factors.

Report this page